On September 2, 2021, iSPIRT Foundation virtually launched the industry-wide ‘Account Aggregator (AA) ecosystem Go-Live’ and announced the joining of 8 Major Banks viz, State Bank of India, ICICI Bank, Axis Bank, IDFC First Bank, Kotak Mahindra Bank, HDFC Bank, IndusInd Bank, and Federal Bank, under AA Network as financial information providers (FIP).

On September 2, 2021, iSPIRT Foundation virtually launched the industry-wide ‘Account Aggregator (AA) ecosystem Go-Live’ and announced the joining of 8 Major Banks viz, State Bank of India, ICICI Bank, Axis Bank, IDFC First Bank, Kotak Mahindra Bank, HDFC Bank, IndusInd Bank, and Federal Bank, under AA Network as financial information providers (FIP).

- The 8 banks and GSTN (Goods and Service Tax Network) have received the in-principle approval from the Reserve Bank of India (RBI) to join the AA network.

Who is an Account Aggregator?

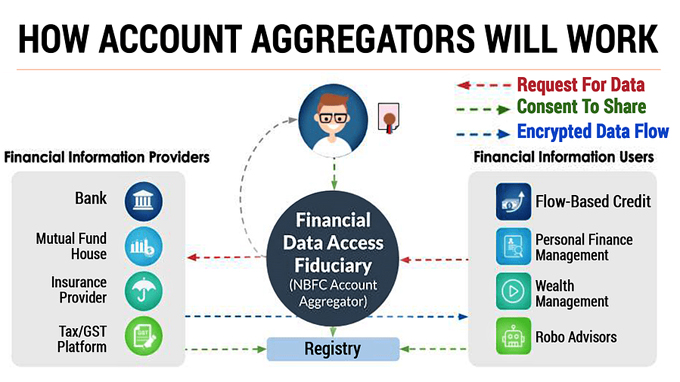

i.AA are data access fiduciary. It will be used for the exchange of financial information from FIPs to Financial Information Users (FIUs) in a safe manner with due customer consent.

iii.AA network will not store/read the customers data in turn it will act as a pipeline between FIPs and FIUs.

- The FIPs may include banks, mutual funds, insurance companies and tax authorities like the GST platform, etc. The FIUs could be banks, wealth advisories, investment firms, etc.

iv.Security: The AA will store the encrypted data till the process is completed and after which the data will be erased from the AAs database. This ensures data security.

v.Speed: If all the financial institutions are included in the AA ecosystem, it will facilitate access to large amounts of financial data within seconds. Background:

Background:

i.In June 2016, RBI approved a new class of non-banking financial companies (NBFCs) called AAs to facilitate consented share of financial information in real-time.

ii.RBI has also announced the AA framework. RBI gives licenses and governs the rules for AAs.

iii.Requirement – Every company seeking registration with the RBI as NBFC – AA should have a net owned fund of not less than Rs 2 crore or such higher amount, as the RBI may specify.

Current and Upcoming AAs:

i.Neo Bank ‘Fi’, Non-bank lenders such as Bajaj Finance Ltd. and DMI Finance are also joining the AA network.

ii.Finvu, OneMoney, NESL, and CAMS Finserv are already live as AA. PhonePe, Perfios, and Yodlee also have received in-principle approval from the RBI to Join the AA network.

Recent Related News:

RBI has included street vendors part of the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi Scheme) in tier-1 and tier-2 centres as beneficiaries under the Payments Infrastructure Development Fund (PIDF) Scheme.

About Reserve Bank of India (RBI):

Established – April 1, 1935

Headquarters – Mumbai, Maharashtra

Governor – Shaktikanta Das

Deputy Governors – Mahesh Kumar Jain, Michael Debabrata Patra, M. Rajeshwar Rao, T. Rabi Sankar