An accidental insurance scheme

PMSBY – Pradhan Mantri Suraksha Bima Yojana is one of the three schemes of social security that were introduced in BUDGET 2015. The other to were

- Pradhan Mantri Jeevan Jyoti Bima Yojana – PMJJBY

- Atal Pension Yojana – APY

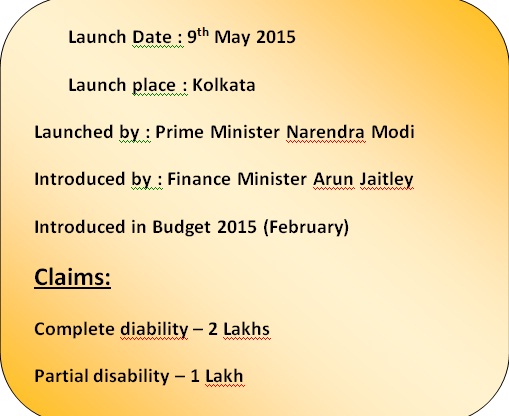

PMSBY is a government – backed accident insurance scheme that was introduced by the Finance Minister Arun Jaitley in BUDGET 2015. It was formally launched on 9th May 2015 by the Prime Minister Narendra Modi in Kolkata.

About PMSBY

The risk coverage for accidental death and permanent disability is Rs 2 lakhs. Under the scheme, Rs 1 lakh will be provided for permanent partial disability.

Here, the Yojana states that permanent partial disabilities include total and irrecoverable loss of both eyes, loss of both hands, or feet or eyesight. Loss of use of hand or foot is also considered as a permanent partial disability under the scheme.

The two main best benefits of the scheme are

- The amount paid under the scheme will be an additional to any other insurance plan the benefiter has claimed for.

- PMSBY is not a Medi – Claim. In other words, there is no need for the reimbursement of hospitalisation expenses after the accident that results in death or disability.

Inclusions and Exclusions of PMSBY

Inclusions

- Death and Disabilities due to accidents are covered under PMSBY

- Health injuries due to natural calamities are also embraced by the Yojana.

- Family gets insurance benefits in all the above cases of death of the person.

Exclusions

- When a person commits suicide, no benefits are provided. The family is also exempted from receiving the benefits of the scheme in the cases of suicide even if it is an occurrence of death.

- Partial disability other than loss of eyesight, loss of a hand or a foot is also not covered.

Eligibility

Indian citizens of age group 18 – 70 are alone eligible to enjoy the benefits of the scheme. When the benefiter has multiple bank accounts he / she can join the scheme through only one bank.

NRIs – The Non – Resident Indians are also eligible to take pleasure in the benefits of the schemes. However, when the claim arises, the benefits will be paid to the beneficiary or the nominee only in Indian currency.

Bright aspects of PMSBY

(Government point of view)

- Review will be done on annual basis. In other words, amount will be credited to the accident victims only on June 1. This is a positive step on government point of view. On the other side, the victims have to wait for the amount to get credited.

- There won’t be any policy certificates issued to the individuals. The participating banks are the master policy holders in the case of PMSBY.

- No upward revisions are permitted for the first three years of the scheme.

Analysis of PMSBY

Premium details

The maximum premium payable by a member is Rs 12 per annum. This amount is deducted from the beneficiary’s bank account through an “AUTO DEBIT” facility. The debit happens automatically from the account on June 1 every year.

The annual renewal date is also June 1.

When one gets enrolled in more than one bank, the claim will be paid only by one bank and the other premiums will get forfeited.

Issuing authorities of PMSBY

The scheme is administered completely by the PSGIC – Public Sector General Insurance Companies. PSGICs have collaborated with the participating banks that volunteered to help the schemes success to implement the scheme fruitfully.

The banks are given full freedom to engage with any insurance company to implement the scheme. PMSBY has also been digitalised. One can enrol themselves online

Process of PMSBY activation

To enrol in the scheme, one can visit http://www.jansuraksha.gov.in/Forms-PMSBY.aspx , download the form, fill it and submit it to their bank where they hold an account.

Activation can be done through net banking also.

SMS based process has been introduced by the government to make the process easy.

SMS Activation

An SMS will be sent to all the eligible customers of India including NRIs to the mobile numbers that are registered with the Aadhar card. The customers simply have to reply ‘Y’ to the same number. After this, an acknowledgement will be sent to the willing customers.

Now, this citizen is eligible for PMSBY. His details of nominee name, address, date of birth, etc will be taken from the bank account linked with the Aadhar number.

In case, if any one of the details given above is not updated with the Government of India, the customer has to apply in person at any branch nearer to him.

Enroling period

Initially the enrolment period was from June 1 2015 to May 31 2016. Now it has been extended without a stipulated time limit.

Though the scheme is registered at any time by the user, the consent is given only on June 1 and the time period of one year is taken only from June 1 to May 31 of the next year.

The customers who wish to continue the bond beyond the year, has to give an auto – debit option to the concerned bank.

Closure of the premium

The premium comes to an end when

- The user attains the age of 70.

- Insufficient balance or closing of bank account.

- The user has opted PMSBY in multiple bank accounts.

Other important facts of PMSBY

The claim is recompensed only when correct documentary evidence is produced.

The PMSBY demands an FIR in the following cases

- Semi – Vehicular accidents

- Rail and Road accidents

- Drowning

- Death involving crime

It demands hospital records for the following cases

- Snake bite

- Fall from tree

Quiz on PMSBY – Test yourself

- When was PMSBY launched?

- When was PMSBY introduced?

- Who introduced PMSBY?

- Where was PMSBY launced first?

- What is the claim amount for a complete disability and partial disability?

- Under what circumstances Government can close a PMSBY account?

- What is the amount deducted from the user account every year for PMSBY?

- Who is the issuing authority of PMSBY?

- When is the yearly closure of PMSBY?

References