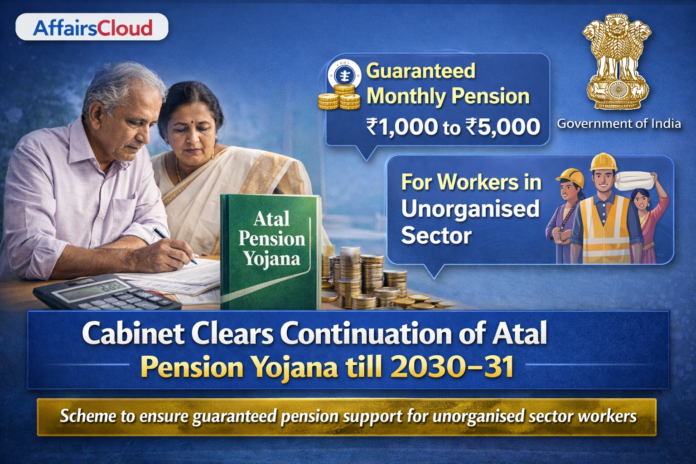

In January 2026, the Union Cabinet chaired by the Prime Minister (PM) Narendra Modi approved the continuation of Atal Pension Yojana (APY) up to Financial Year 2030-31 (FY31) along with extension of funding support for promotional and developmental activities and gap funding.

Exam Hints:

- Approved: Union Cabinet approves continuation of APY till 2030-31

- Scheme Type: Voluntary pension scheme

- Target Group: All Indians with focus on under-privileged, workers in unorganised sector

- Administered by: PFRDA

- Age Limit: 18-40 years

- Pension Amount: Rs 1000 to Rs 5000 per month after 60 years

- Monthly Contribution: Rs.42 to Rs.1,454

- Minimum Contribution Period: 20 years

- Total Subscribers: 8.66 Cr (Jan 2026)

About Atal Pension Yojana (APY):

Purpose: The Government of India (GoI) launched the APY on 9th May 2015 to create a universal social security system for all Indians, especially the poor, the under-privileged and the workers in the unorganised sector.

Implementation: The Scheme is being implemented with effect from 1st June 2015.

Administration: The APY is administered by the Pension Fund Regulatory and Development Authority (PFRDA) under the overall administrative and institutional architecture of the National Pension System (NPS).

- It is being implemented through Public Sector Banks (PSB), Private Banks , Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Payments Banks (PBs), Co-operative Banks(CBs) and Department of Posts (DoP).

Age Criteria: The minimum age of joining APY is 18 years (Yrs) and maximum age is 40 Yrs.

Restriction: With effect from 1st October 2022, any citizen who is or has been an income-tax payer is not eligible to join APY.

Triple Benefits:

Benefits: APY is a voluntary, periodic contribution based pension system, under which, the subscriber is entitled to receive the following three benefits.

- Guaranteed Pension Amount: Each subscriber under APY shall receive a Central Government guaranteed minimum pension ranging from Rs. 1000 per month to Rs. 5000 per month, after the age of 60 years until death.

- Pension Amount to Spouse: After the subscriber’s demise, the spouse of the subscriber shall be entitled to receive the same pension amount as that of the subscriber until the death of the spouse.

- Pension wealth to Nominee: After the demise of both the subscriber and the spouse, the nominee of the subscriber shall be entitled to receive the pension wealth, as accumulated till age 60 of the subscriber.

Other Key Details:

Contribution: The scheme requires a minimum contribution period of 20 years, which varies based on the subscriber’s age at the time of enrolment.

- Subscribers joining at 18 years contribute Rs.42–Rs.210 per month, while those joining at 40 years contribute Rs.291–Rs.1,454 per month, with contributions payable monthly, quarterly, or half-yearly.

Government Co-contribution: The Government of India(GoI) contributed 50% of the subscriber’s contribution or Rs.1,000 per year (whichever was lower) for five years for APY subscribers who joined between June 1, 2015 and March 31, 2016, the scheme now continues without co-contribution.

Exit and Withdrawal Options:

Under APY, a subscriber receives the full guaranteed pension on exit after attaining 60 years of age. Premature exit before 60 years is permitted only in exceptional cases such as the subscriber’s death or terminal illness.

- Voluntary exit is also allowed. However, in such cases, the subscriber is entitled only to the accumulated contribution along with interest, and any government co-contribution, if applicable, is forfeited.

Progress: As of 19th January, 2026, APY has enrolled more than 8.66 crore (Cr) subscribers, emerging as a key pillar of India’s inclusive social security system.

- PSBs have dominated enrolments, accounting for approximately 70.44% of total subscriptions, whilst RRBs contributed 19.80%.

Implementation Strategy: The scheme will continue up to FY31 with Government support for:

- Promotional and developmental activities to expand outreach among unorganised workers, including awareness creation and capacity building.

- Gap funding to meet viability requirements and ensure the sustainability of the scheme.

Recent Related News:

On 25 December 2025, the Pradhan Mantri Gram Sadak Yojana (PMGSY), launched on 25 December 2000 as one of India’s most transformative rural infrastructure programmes, celebrated its 25th anniversary.

- PMGSY has approved over 8,25,114 kilometre (km) of rural roads and completed around 787,520 km, achieving nearly 95% of the planned physical progress as of December 2025.