In January 2025, the Reserve Bank of India (RBI) released Payment System Report, December 2024, which analysed the trends in payment transactions carried out using different payment systems in the last 5 Calendar Years (CY) up to CY-2024.

In January 2025, the Reserve Bank of India (RBI) released Payment System Report, December 2024, which analysed the trends in payment transactions carried out using different payment systems in the last 5 Calendar Years (CY) up to CY-2024.

- The report has covered key developments in the payment ecosystem and provides in-depth information about Unified Payments Interface (UPI).

- Henceforth, this report will be published on RBI website bi-annually.

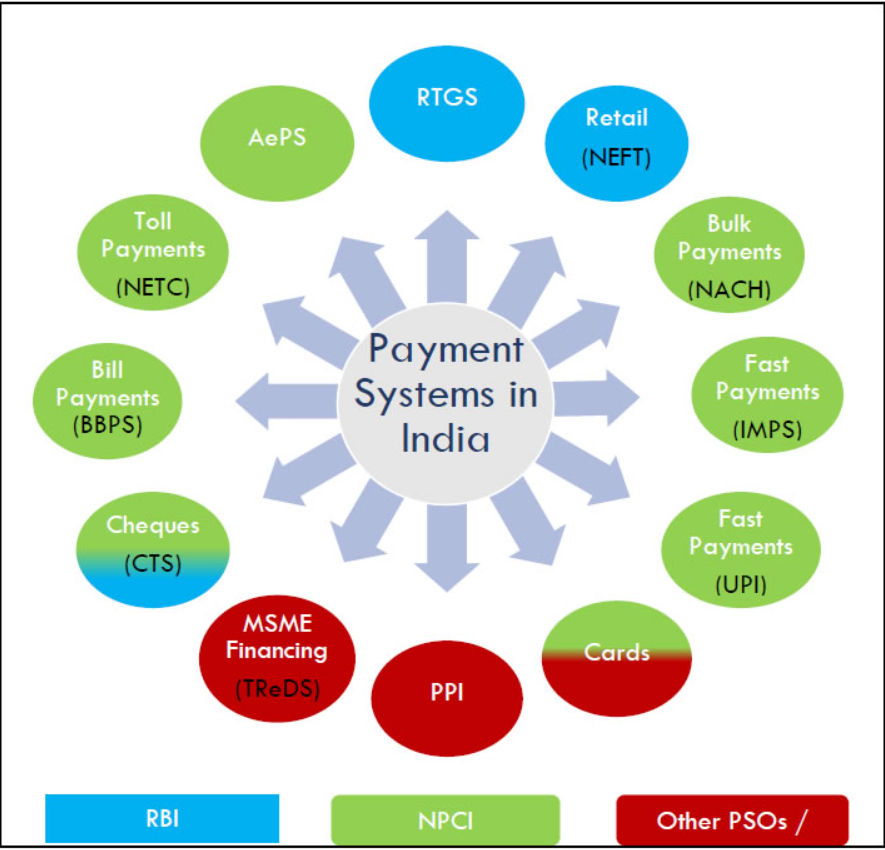

Key Findings: *PSO – Payment System Operators

*PSO – Payment System Operators

i.Exponential increase in Digital Payment transactions: As per the report, 222 crore digital transactions valued at Rs 772 lakh crore were made in CY-2013, it has increased 94 times in volume and more than 3.5 times in value to more than 20,787 crore transactions valued at Rs 2,758 lakh crore in CY24.

- The report revealed that digital payments in India have increased 6.7 times in volume and 1.6 times in value in the last 5 years.

- Also, this reflects a 5-year Compound Annual Growth Rate (CAGR) of 45.9% and 10.2% in terms of digital payments volume and value respectively.

ii.Growth of Credit Card and Debit Card: The report showed that the number of credit cards in circulation has more than doubled in the last 5 years, from 5.53 credit cards in circulation in December 2019 to nearly 10.80 crore at the end of December 2024.

- In contrast to credit cards, the number of debit cards in circulation has remained relatively stable, with a slight increase from 80.53 crore (in December 2019) to slightly more than 99.09 crore (December 2024).

iii.Surge in Retail Digital Payments: The report showed that the retail digital payments in India has surged from 162 crore transactions in Financial Year 2012-13 (FY13) to 16, 416 crore transactions in FY24, reflecting a nearly 100-fold increase over 12 years.

iv.The Growth of UPI Payments: UPI has emerged as the significant contributor to growth of digital payments in India. The contribution of UPI to digital payments volume increased from 34% in CY-2019 to 83% in CY-2024, with a remarkable CAGR of 74% over 5 years.

- The volume of UPI transactions increased from 375 crore in CY-2018 to 17,221 crore in CY-2024 and the total value of transactions increased from 5.86 lakh crore in CY-2018 to Rs 246.83 lakh crore in CY-2024.

- This reflects 5 year CAGR of 89.3% and 86.5% in terms of volume and value, respectively.

v.Increase in DPI: As per the report, the Digital Payment Index (DPI), a key indicator which measures the growth of payment systems, has increased by more than 4 times in the last 6 years, from a base of 100 (in March 2018) to 445.50 (in March 2024).

Key Global Trends:

i.The report highlighted that the RBI has been working towards enhancing cross-border payments by linking UPI with Fast Payment Systems (FPS) of other countries.

- In February 2023, the FPS of India (UPI) and Singapore (PayNow) were linked together.

ii.India joined Project Nexus, facilitating multilateral linkage of FPS of Association of Southeast Asian Nations (ASEAN) countries i.e. Malaysia, Philippines, Singapore, and Thailand. An agreement to this effect was signed on June 30, 2024.

- Project Nexus was conceptualized by Singapore-based Bank for International Settlements (BIS) Innovation Hub, to develop ‘Nexus’ as a multilateral network connecting domestic Instant Payment System (IPS) networks of participating countries.

iii.Payments to merchants using Indian UPI applications via Quick Response (QR) codes has been enabled in various countries like: Bhutan, France, Mauritius, Nepal, Singapore, Sri Lanka, and the United Arab Emirates (UAE).

About Payment and Settlement Systems Act, 2007:

i.The Act has authorised RBI to regulate and supervise payment systems in India.

ii.The Act empowers RBI to issue licenses/authorisations to payment system operators. These operators include entities involved in operating and maintaining various types of payment systems like: Clearing Corporation of India Limited (CCIL), National Payments Corporation of India (NPCI), among others.

iii.The Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) is chaired by Sanjay Malhotra, RBI Governor.

Recent Related News:

In January 2025, RBI released its latest Annual Report of the Ombudsman Scheme, 2023-24. As per the report, RBI resolved 95% (i.e. 2.84 lakh) complaints received under the Reserve Bank-Integrated Ombudsman Scheme (RB-IOS) between April 1, 2023 and March 31, 2024 and achieved a disposable rate of 95.10%.

- The report revealed that a total of 9,34,355 complaints were received by the Offices of the RBI Ombudsman(ORBIOs) and the Centralised Receipt and Processing Centre (CRPC).