On January 3, 2025, New Delhi (Delhi) based Employees’ Provident Fund Organisation (EPFO) successfully completed the nationwide implementation of the Centralized Pension Payments System (CPPS) under the Employees’ Pension Scheme (EPS) 1995, aiming to improve the ease of living for pensioners by streamlining pension disbursements across all regional offices.

On January 3, 2025, New Delhi (Delhi) based Employees’ Provident Fund Organisation (EPFO) successfully completed the nationwide implementation of the Centralized Pension Payments System (CPPS) under the Employees’ Pension Scheme (EPS) 1995, aiming to improve the ease of living for pensioners by streamlining pension disbursements across all regional offices.

- The initiative allows pensioners to access their pensions easily from any bank branch nationwide, removing the need for physical verification and streamlining the disbursement process.

- This marks a transition from the current decentralized pension disbursement system, where each zonal or regional office of EPFO has separate agreements with only three to four banks.

Key Points:

i.In October 2024, the initial pilot of the CPPS was completed at the Karnal (Haryana), Jammu (Jammu & Kashmir, J&K) and Srinagar (J&K) regional offices, disbursing approximately Rs. 11 crore in pensions to more than 49,000 EPS pensioners.

ii.In November 2024, a second pilot was completed across 24 regional offices, disbursing approximately Rs. 213 crore in pensions to over 9.3 lakh pensioners.

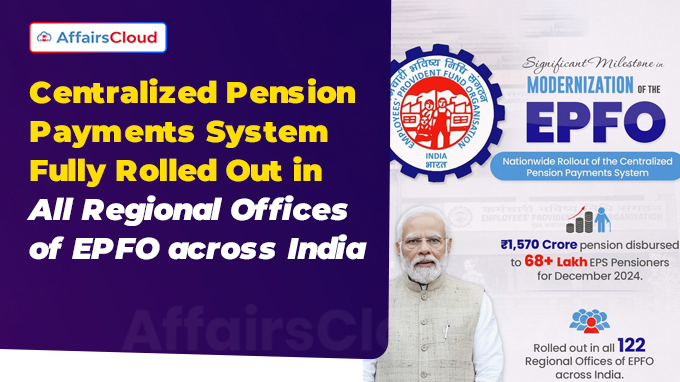

iii.In December 2024, approximately Rs. 1,570 crore in pensions was disbursed to over 68 lakh pensioners through all 122 regional offices of EPFO.

About the Centralised Pension Payments System (CPPS):

i.The CPPS enables over 78 lakh EPS pensioners to receive their pensions from any bank branch nationwide, streamlining payments, removing the need for physical verifications, and ensuring seamless disbursement.

- It is implemented by the Employees’ Provident Fund Organisation (EPFO), New Delhi(Delhi).

ii.It ensures nationwide pension disbursement without requiring Pension Payment Orders (PPO) transfers, even if pensioners relocate or change their bank or branch. This provides significant relief to those retiring to their hometowns.

iii.Pensioners will no longer need to visit a branch for verification when their pension begins, as it will be credited immediately upon release.

iv.CPPS will enable a smooth transition to Aadhaar-based payment system (ABPS) in the next phase.

Note: EPFO has invested Rs. 34,207.9 crore in Exchange Traded Funds (ETFs) in the Financial Year 2024-25(FY25).

About Employees’ Provident Fund Organisation (EPFO):

The EPFO is a statutory body under the Ministry of Labour and Employment (MoL&E) responsible for regulating and managing provident funds in India.

- The board is chaired by the Union Minister of Labour and Employment (MoL&E), Government of India (GoI).

Central Provident Fund Commissioner (CPFC) – Ramesh Krishnamurti

Headquarters – New Delhi, Delhi

Founded – 1952