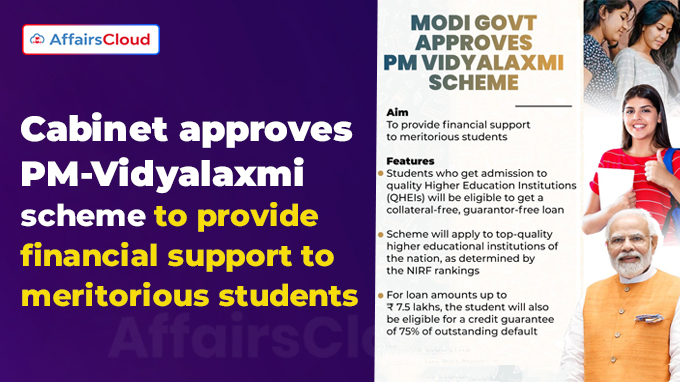

On 6th November 2024, the Union Cabinet chaired by Prime Minister (PM) Narendra Modi, has approved ‘PM Vidyalaxmi’ scheme, a new Central Sector Scheme (CSS) which aims to provide financial assistance to meritorious students, ensuring that financial constraints do not hinder anyone from pursuing higher studies.

On 6th November 2024, the Union Cabinet chaired by Prime Minister (PM) Narendra Modi, has approved ‘PM Vidyalaxmi’ scheme, a new Central Sector Scheme (CSS) which aims to provide financial assistance to meritorious students, ensuring that financial constraints do not hinder anyone from pursuing higher studies.

- The government has allocated Rs 3,600 crore for the scheme during the period from Financial Year 2024-25 (FY25) to FY31, and 7 lakh new students are expected to avail the benefit of this interest subvention during the period.

- The scheme is a key initiative stemming out of the National Education Policy, 2020 (NEP 2020) which had recommended to provide financial support to meritorious students in both public and private Higher Education Institutions (HEIs).

- As per the scheme, any meritorious student who gets admission in Quality Higher Educational Institutions (QHEIs) will be eligible to get collateral free, guarantor-free loan from banks and Financial Institutions (FIs) to cover tuition fees and other course-related expenses.

About PM Vidyalaxmi Scheme:

i.Eligible QHEIs: The scheme will cover the top QHEIs of the country, as determined by the National Institutional Ranking Framework (NIRF) rankings, including all HEIs, government and private, that are ranked within the top 100 in NIRF in overall, category-specific and domain specific rankings; state government HEIs ranked in 101-200 in NIRF and all central government governed institutions.

- As per the scheme, the list of eligible QHEIs will be updated annually using the latest NIRF rankings.

- For the initial phase, the scheme will select top 860 QHEIs, covering over 22 lakh students who may avail the benefits of PM-Vidyalaxmi, if they so desire.

ii.Collateral-free and Guarantor-free loan of up to Rs 7.5 lakh: Under the scheme, the Government of India (GoI)will provide a 75% credit guarantee for maximum loan amount of Rs 7.5 lakh, assisting banks in expanding their coverage and support for students.

iii.Additional Interest Subvention: According to the scheme, students with a family income of up to Rs 8 lakh will receive interest subvention of 3% on loans up to Rs 10 lakh during the moratorium period. The interest subvention support will be provided to 1 lakh students annually.

- This interest subvention facility will be preferred to students who are from government institutions and are pursuing technical/professional courses.

- This is in addition to full interest subvention already offered to students with annual family income up to Rs 4.5 lakhs.

iv.PM-Vidyalaxmi portal: The Department of Higher Education (DoHE), Ministry of Education (MoE) will introduce a unified government portal, PM-Vidyalaxmi where students can easily apply for education loans and interest subvention from all banks.

- The payments of interest subvention will be made through e-voucher and Central Bank Digital Currency (CBDC) wallets.

Points to Note:

i.PM-Vidyalaxmi is in alignment with the Central Sector Interest Subsidy (CSIS) and Credit Guarantee Fund Scheme for Education Loans (CGFSEL), both are component schemes of Pradhan Mantri Uchchatar Shiksha Protsahan (PM-USP), being implemented by DoHE.

iii.Under PM-USP CSIS, full interest subvention during moratorium period for education loans up to Rs 10 Lakh is offered to students with annual family income up to Rs 4.5 lakhs and pursuing technical/professional courses from approved institutions.

CCEA Approved Rs 10,700 Crore Equity Infusion in FCI by Way of Conversion of WMA to Equity in FY25

On 6th November 2024, the Cabinet Committee on Economic Affairs (CCEA) chaired by PM Narendra Modi has approved an equity infusion of Rs 10,700 crore for the Food Corporation of India (FCI), to support its working capital requirements for the Financial Year 2024-25 (FY25).

- The equity will be infused by converting the Ways and Means Advance (WMA), a temporary loan is given by the GoI to the FCI to meet financial mismatches in government receipts and payments.

- The FCI is required to repay the WMA by 31st March, 2025. The interest rate for the loan is the same as the weighted average rate of interest for 364-day Treasury Bills(T-Bills) for the relevant financial year.

- This decision of the central government is aimed to strengthen the agricultural sector and to ensure the welfare of farmers nationwide and reflects the GoI’s commitment to supporting farmers and fortifying India’s agrarian economy.

Key Points:

i.FCI started its operations in 1965 with authorised capital of Rs 100 crores and equity of Rs 4 crores.

ii.Over the years, the operations of FCI has increased manifold which resulted in an increase of authorised capital from Rs 11,000 crore to Rs 21,000 crore in February 2023.

iii.The equity of FCI has increased from Rs 4,496 crore in FY20 to Rs 10,157 crore in FY24.

About Food Corporation of India (FCI):

It is a statutory body established under the FCI Act, 1964, to implement the food policy of the government. It works under the Ministry of Consumer Affairs, Food and Public Distribution (MoCAF&PD).

- Its main objective is to ensure Minimum Support Price (MSP) to farmers, maintain buffer stock and distribution of food grains under National Food Security Act, 2013.

Chairman & Managing Director (CMD)- Ashok K. K. Meena

Headquarters- New Delhi, Delhi

Established – 1965