We are here for you to provide the important Recent and Latest Current Affairs 1 October 2024, which have unique updates of Latest Current Affairs 2024 events from all newspapers such as The Hindu, The Economic Times, PIB, Times of India, PTI, Indian Express, Business Standard and all Government official websites.

Our Current Affairs October 2024 events will help you to get more marks in Banking, Insurance, SSC, Railways, UPSC, CLAT and all State Government Exams. Also, try our Latest Current Affairs Quiz and Monthly Current Affairs 2024 PDF which will be a pedestrian to crack your exams.

Read Current Affairs in CareersCloud APP, Course Name – Learn Current Affairs – Free Course – Click Here to Download the APP

Click here for Current Affairs 29 & 30 September 2024

Click here for Affairscloud Hindu Free Vocabs telegram channel

NATIONAL AFFAIRS

4th Global RE-INVEST Renewable Energy Investors Meet & Expo held in Gujarat Global Renewable Energy Investor’s Meet and Expo (RE-INVEST) 2024, the 4th edition of the flagship event by the Ministry of New and Renewable Energy(MNRE), was held at the Mahatma Mandir Convention and Exhibition Centre, Gandhinagar, Gujarat from 16th to 18th September 2024.

Global Renewable Energy Investor’s Meet and Expo (RE-INVEST) 2024, the 4th edition of the flagship event by the Ministry of New and Renewable Energy(MNRE), was held at the Mahatma Mandir Convention and Exhibition Centre, Gandhinagar, Gujarat from 16th to 18th September 2024.

- The 3-day summit was inaugurated by Prime Minister(PM) Narendra Modi on 16th September 2024.

- Global RE-INVEST 2024 was organised in partnership with the Confederation of Indian Industry (CII).

i.REC Limited, formerly Rural Electrification Corporation Limited, has signed a Memorandum of Understandings (MoUs) with renewable energy (RE) developers to fund projects worth around Rs.1.12 lakh crore.

ii.During Global RE-INVEST 2024, Gujarat has won numerous awards for its renewable energy achievements. Gujarat was ranked among the top 3 in overall renewable energy capacity, solar power capacity and wind power capacity.

iii.Union Minister Pralhad Joshi, MNRE, stated that the 4th Global RE-INVEST drew investment commitments worth Rs 32.45 lakh crore in the form of Shapath Patra by 2030.

>> Read Full News

MoHFW Released National Health Accounts Estimates for India 2020-21 and 2021-22 On 25th September 2024, the Union Ministry of Health and Family Welfare (MoHFW) has released the National Health Accounts (NHA) Estimates for India for 2020-21 and 2021-22. These are 8th and 9th edition of reports released annually by the MoHFW.

On 25th September 2024, the Union Ministry of Health and Family Welfare (MoHFW) has released the National Health Accounts (NHA) Estimates for India for 2020-21 and 2021-22. These are 8th and 9th edition of reports released annually by the MoHFW.

Key Points:

i.As per these latest NHA estimates, the Out-of-Pocket Expenditure (OOPE) out of the Total Health Expenditure has decreased significantly from 64.2% (in 2013-14) to 39.4% (in 2021-22) which shows positive indicator in health sector.

ii.As per the NHA, share of Government Health Expenditure (GHE) in the overall Gross Domestic Product (GDP) of the country has increased from 1.13% (in 2014-15) to 1.84% (in 2021-22).

iii.Also, GHE in terms of the General Government Expenditure (GGE) has increased from 3.94% (in 2014-15) to 6.12% (in 2021-22).

About Ministry of Health and Family Welfare(MoHFW):

Union Minister– Jagat Prakash Nadda (Rajya Sabha – Gujarat)

Union Minister of State (MoS)- Anupriya Patel(Lok Sabha constituency- Mirzapur, Uttar Pradesh); Jadhav Prataprao Ganpatrao (Lok Sabha constituency- Buldhana, Maharashtra)

>> Read Full News

Secretary of DoA&FW, Dr. Devesh Chaturvedi Chaired a Review Meeting of UN World Food Programme– CPAC On 26th September 2024, Dr. Devesh Chaturvedi, Secretary, Department of Agriculture and Farmers’ Welfare (DoA&FW) under the Ministry of Agriculture and Farmers’ Welfare (MoA&FW), chaired the 1st meeting of the Country Programme Advisory Committee (CPAC) to review the implementation of the Country Strategic Plan (CSP) 2023-2027 with representatives of the United Nations World Food Programme (UN WFP) in New Delhi, Delhi.

On 26th September 2024, Dr. Devesh Chaturvedi, Secretary, Department of Agriculture and Farmers’ Welfare (DoA&FW) under the Ministry of Agriculture and Farmers’ Welfare (MoA&FW), chaired the 1st meeting of the Country Programme Advisory Committee (CPAC) to review the implementation of the Country Strategic Plan (CSP) 2023-2027 with representatives of the United Nations World Food Programme (UN WFP) in New Delhi, Delhi.

Key Participants: Elizabeth Faure, the Country Director of WFP, the representatives and officers from Ministry of Women and Child Development (MoWCD); Department of School Education & Literacy (DoSE&L), Ministry of External Affairs (MEA), National Disaster Management Authority (NDMA), among others were present at the meeting.

About CPAC:

i.CPAC has been constituted under the chairperson Dr. Devesh Chaturvedi and its members include joint secretaries of concerned ministries and National Institution for Transforming India (NITI Aayog).

- The key function of CPAC is to coordinate and review the progress under CSP 2023-27.

ii.It is mandatory for CPAC to meet at least once in year.

MoU between DoA&FW and UN WFP:

i.During the meeting, a Memorandum of Understanding (MoU) was signed between the DoA&FW and the UN WFP, aimed to address the national priorities in food security and nutrition through capacity building and technical support.

ii.As per the MoU, the CSP 2023-27 focuses on 4 strategic outcomes which includes: more effective and efficient national food-based social protection systems; rising consumption of diverse, nutritious, and fortified foods; enhancing the social and financial mobility of women; and strengthening the adaptive capacity to build climate-resilient livelihoods and food systems.

About World Food Programme (WFP):

Executive Director(ED)- Cindy H. McCain

Headquarters- Rome, Italy

Established- 1961

INTERNATIONAL AFFAIRS

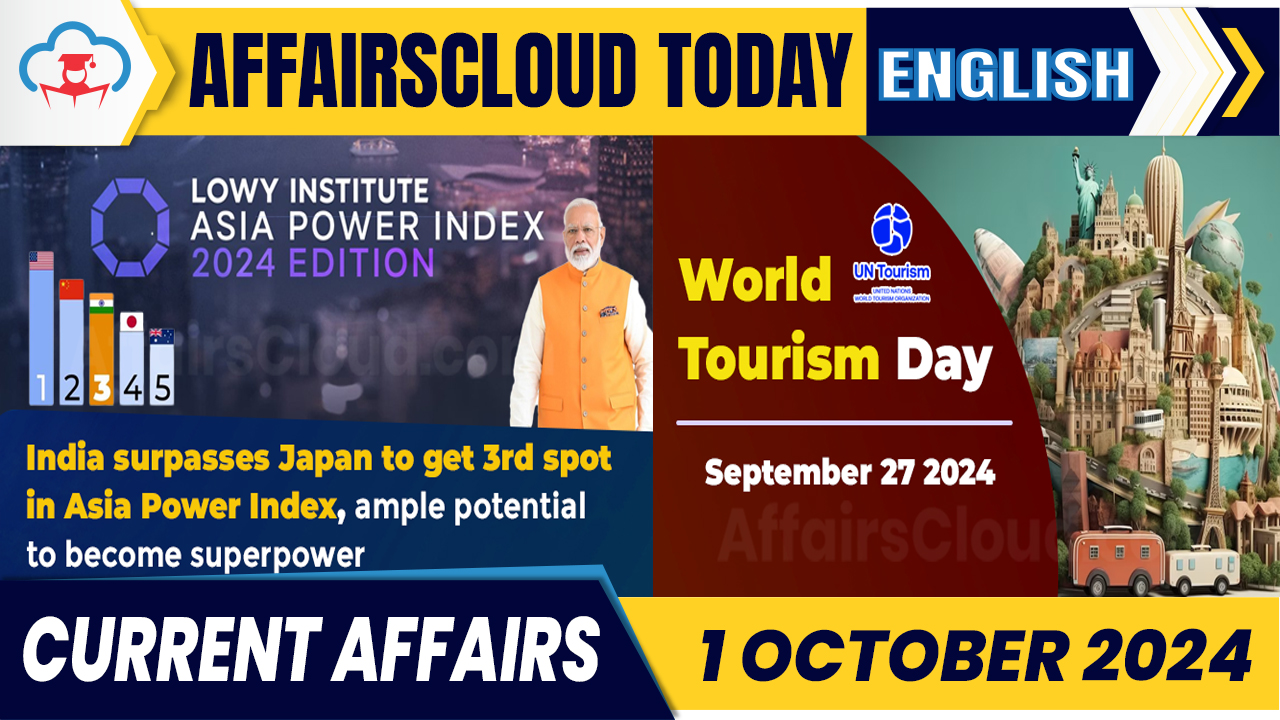

India Ranked 3rd in Asia Power Index 2024; USA Topped According to the ‘Asia Power Index 2024 Edition‘ released by Lowy institute, based in Sydney, Australia, India is ranked 3rd with score of 39.1 out of 100 surpassing Japan amid strong post-COVID 19 economic growth.

According to the ‘Asia Power Index 2024 Edition‘ released by Lowy institute, based in Sydney, Australia, India is ranked 3rd with score of 39.1 out of 100 surpassing Japan amid strong post-COVID 19 economic growth.

- The 2024 index is topped by the United States of America (USA) with a score of 81.7, followed by China at 2nd place (72.7). Papua New Guinea, ranked last at 27th with a score of 4.2.

- India’s rank i.e. comprehensive power ranking rose by 1 in 2024, with a 2.8-point (+8%) score increase. This marks the first edition of the Asia Power Index where India has raised its power score, though still below 2018-2019 levels.

About Asia Power Index:

i.The Asia Power Index annually measures resources and influence to assess state power in Asia since 2018. The index consists of 8 measures of power, 30 thematic sub-measures and 131 indicators.

ii.It ranks 27 countries and territories based on their resources and how they use them.

About Lowy Institute:

Chairman of the Board– Sir Frank Lowy AC

Headquarters– Sydney, Australia

>> Read Full News

BANKING & FINANCE

NIPL & Trinidad and Tobago Partners to Develop UPI-like Payments System On 27th September 2024, NPCI International Payments Limited (NIPL), a wholly-owned subsidiary of the National Payments Corporation of India (NPCI), entered into a strategic partnership with the Ministry of Digital Transformation (MDT) of Trinidad and Tobago to build a real-time digital payments system modeled after the Unified Payments Interface (UPI) of India.

On 27th September 2024, NPCI International Payments Limited (NIPL), a wholly-owned subsidiary of the National Payments Corporation of India (NPCI), entered into a strategic partnership with the Ministry of Digital Transformation (MDT) of Trinidad and Tobago to build a real-time digital payments system modeled after the Unified Payments Interface (UPI) of India.

- With this, Trinidad and Tobago became the first Caribbean nation to adopt UPI.

Key Points:

i.This agreement will enable Trinidad and Tobago to establish a real-time payment platform for both person-to-person (P2P) and person-to-merchant (P2M) transactions expanding digital payments and fostering financial inclusion.

ii.This will also support Trinidad and Tobago to modernise its financial ecosystem.

iii.The accessibility, affordability, and connectivity with domestic and international payment networks will be enhanced

Note:

i.At present, Indians can pay selected merchants in Bhutan, France, Mauritius, Nepal, Singapore, Sri Lanka, and the United Arab Emirates (UAE).

ii.In 2024, NIPL inked an agreement with the Central Bank of Peru and Bank of Namibia (BoN) to develop a UPI-like payment system.

About NPCI International Payments Limited (NIPL):

Chief Executive Officer(CEO)– Ritesh Shukla

Headquarters– Mumbai, Maharashtra

Incorporated– 2020

PNB Introduces Multi-Currency World Travel Card for International Travelers Punjab National Bank (PNB) has launched the “PNB Multi-Currency World Travel Card (MCWTC)”, a prepaid foreign currency card, which allows users to load and manage multiple currencies on a single card.

Punjab National Bank (PNB) has launched the “PNB Multi-Currency World Travel Card (MCWTC)”, a prepaid foreign currency card, which allows users to load and manage multiple currencies on a single card.

- The card supports 6 major foreign currencies: United States Dollar (USD), Euro (EUR), British Pound Sterling (GBP), United Arab Emirates Dirham (AED), Canadian Dollar (CAD), and Singapore Dollar (SGD).

About PNB MCWTC:

Eligibility:

Indian Nationals with valid Permanent Account Number(PAN) Cardholder and desirous of visiting/travelling abroad for any purpose as permitted by the Reserve Bank of India(RBI).

Features:

i.The card can be used across the globe except in India, Nepal and Bhutan.

ii.The card may be issued against cash for an amount below Rs. 50,000. It is equipped with 3D Secure and Chip-and-Personal Identification Number (PIN)technology and offers real-time transaction alerts.

iii.The card offers the option to lock in exchange rates at the time of loading helping travellers to avoid fluctuations in currency rates while abroad.

iv.The card is accepted at Automated Teller Machines (ATMs), point-of-sale (POS) terminals, and for online transactions across the globe.

- It also support for contactless payments for convenience.

v.The card also includes insurance coverage of up to Rs 3.50 lakh for theft or misuse.

About Punjab National Bank (PNB):

PNB commenced its operations on 12th April 1895 from Lahore and was nationalised on 19th July 1969.

Managing Director (MD) and Chief Executive Officer (CEO)– Atul Kumar Goel

Headquarters– New Delhi, Delhi

Tagline– The Name You Can Bank Upon

BOBCARD & RuPay partner to launch EMI feature on UPI payments

BOBCARD Limited, a Non-Banking Financial Company (NBFC) and a wholly owned by Bank of Baroda (BoB), has partnered with RuPay to launch an Equated Monthly Installment (EMI) feature on Unified Payments Interface (UPI) payments, allowing users to convert their purchases into EMIs for a more convenient payment experience.

i.Payments can be made via UPI at both online and offline merchants, with the option to convert transactions into EMIs at checkout.

ii.Customers can apply for EMIs directly through their linked RuPay credit card on any UPI app, using their UPI PIN for consent.

iii.Users can select the EMI option and instalment period at the time of payment and track ongoing EMIs through the UPI app.

iv.The feature targets the festive season and aims to boost digital credit adoption, especially in Tier 2 and Tier 3 cities.

Note: Mumbai, Maharashtra based-BOBCARD Limited, formerly known as BOB Financial Solutions Limited, was established in 1994.

AU SFB announces partnership with Kotak Life offering Life Insurance Solutions

AU Small Finance Bank (AU SFB) has partnered with Kotak Mahindra Life Insurance Company Limited to offer life insurance solutions, expanding AU SFB’s product offerings and enhancing financial security for its customers.

i.The partnership provides AU SFB customers access to Kotak Life’s comprehensive life insurance products, including term, retirement, savings, and investment plans.

ii.The collaboration extends to both new and existing customers, including those from former Fincare SFB branches.

iii.This partnership will strengthen AU SFB’s presence in southern India by leveraging Kotak Life’s portfolio.

India Extends USD 50 Million Budgetary Support to Maldives for another Year

India has extended the budgetary support to the Government of Maldives in the form of rollover worth USD 50 million Treasury Bills (T-bills) for another year, at the request of Maldivian government.

- This extension has been granted by the State Bank of India (SBI), India’s largest Public Sector Bank (PSB), which has subscribed the USD 50 million T-bills issued by the Ministry of Finance, Maldives for another year.

- This marks the 2nd rollover granted by the Government of India in 2024, after the 1st rollover of USD 50 million T-bills was granted in May 2024.

Note: Maldives is a key partner country of India’s ‘Neighbourhood First Policy’ and Security and Growth for All in the Region (SAGAR) vision.

SEBI Allows MFs to Sell Credit Default Swaps to Boost Corporate Bond Liquidity

On 20th September 2024, the Securities and Exchange Board of India (SEBI) has now allowed Mutual Funds (MFs) to sell Credit Default Swaps (CDSs), a move which aimed to boost liquidity in the corporate bond market.

- This announcement was made by SEBI in circular issued in exercise of powers given under Section 11 (1) of the SEBI Act, 1992, read with the provisions of regulation 43 (1) and regulation 77 of SEBI (Mutual Funds) Regulations, 1996.

- Earlier, MFs could only engage in CDS transactions as buyers, basically to hedge credit risks on corporate bonds within Fixed Maturity Plans (FMPS) lasting for over one year.

Key Changes:

i.The MF schemes are allowed to sell CDS only within the scope of investing in synthetic debt securities backed by cash, Government Securities (G-Secs), or Treasury Bills (T-bills).

ii.As per new guidelines, the total exposure for a scheme including, both buying and selling CDSs should not exceed 10% the scheme’s assets. CDS will be valued based on actual traded levels or credit spreads.

iii.SEBI has directed the MFs to disclose details of their CDS transactions like: the rating of CDS seller and deals with sponsor group companies.

Note: CDS is a credit derivative that provides protection to buyer against potential default and helps to manage and transfer credit risk.

ENVIRONMENT

Exostoma sentiyonoae: New Catfish Species Discovered from Nagaland Scientists have discovered a new species of glyptosternine catfish, Exostoma sentiyonoae, has been discovered in the Dzuleke River, a tributary of the Barak River in Nagaland. The details of the discovery is published in journal Zootaxa, a peer-reviewed scientific mega journal for animal taxonomists.

Scientists have discovered a new species of glyptosternine catfish, Exostoma sentiyonoae, has been discovered in the Dzuleke River, a tributary of the Barak River in Nagaland. The details of the discovery is published in journal Zootaxa, a peer-reviewed scientific mega journal for animal taxonomists.

- The new species was discovered by Dr. Limatemjen, Professor and Dean of Sciences at Kohima Science College, Nagaland, and Bungdon Shangningam a scientist from the Zoological Survey of India (ZSI) in Kolkata, West Bengal (WB).

- Dr Limatemjen said he named the species in honor of his daughter, combining “Senti” from the Ao Naga language and “Yono” from the Angami Naga language.

About Exostoma sentiyonoae:

i.It measures 75.8 mm and is cataloged as holotype ZSI FF 9871.

ii.Unique characteristics include an adipose fin attached to the upper caudal-fin rays, tubercles on the dorsal-fin spine, a slender head, a large gap between dorsal and adipose fins, small eyes, and 41 vertebrae.

iii.It is differentiated from related species E. berdmorei and E. gaoligongense based on fin length, distance between fins, and eye size.

iv.This is the fourth species of Exostoma described from the Barak drainage and the first from the Dzuleke River.

Note:

Dr. Limatemjen’s previous work includes discoveries like Chordodes combiaerolatus (2015), Beatogordius (2017), Platylomia kohimanensis (2021), and Pterocryptis barakensis (2023), highlighting his contributions to taxonomy.

India Records 1st Sighting of Rare Reef Fish off Andhra Pradesh Coast

A four-year faunal survey by the ZSI along Andhra Pradesh’s (AP) coast led to the first-ever Indian sighting of Entomacrodus thalassinus, a rare reef fish. It was previously recorded in regions like Japan, French Polynesia, Australia, Sri Lanka, Papua New Guinea, Philippines, New Caledonia, Seychelles, Madagascar.

Key Points:

i.Entomacrodus thalassinus was found among intertidal rocky reefs near Visakhapatnam Fishing Harbour during low tides.

ii.ZSI scientist J.S. Yogesh Kumar, along with support from Livein Adventures, led the research.

iii.The survey also discovered 13 new sea slugs, 11 undocumented fish species, and 2 new brachyuran crabs along the Andhra Pradesh coast.

iv.A medium-sized whale shark was spotted near Santhapalli Rocks off Visakhapatnam.

OBITUARY

Italian Striker, Salvatore ‘Toto’ Schillaci passed away

Italian Striker Salvatore Schillaci, famously known as ‘Toto’ Schillaci, who was top scorer at 1990 International Federation of Association Football (FIFA) World Cup, has died at the age of 59 in Palermo, Italy. He was born in Palermo in 1964.

i.He joined Juventus FC in 1989 and went on to win the Coppa Italia and Union of European Football Associations (UEFA Cup) with Turin club in 1989-90.

ii.He scored six goals during the 1990 World Cup and received the FIFA Golden Boot award and the FIFA Golden Ball award.

iii.He played for various football clubs (FCs) during the course of his football career like: Messina, Juventus, Internazionale and Japanese club ‘Jublio Iwata’. He retired from all formats of Football in 1999.

BOOKS & AUTHORS

Sukhvinder Singh Sukhu Released two books,”Jalandhar Peeth Ka Rahsya”, “Mushtarka Khata” authored by Ajay Prashar

On 19th September 2024, Sukhvinder Singh Sukhu, Chief Minister (CM) of Himachal Pradesh (HP) released two books, “Jalandhar Peeth Ka Rahsya” and “Mushtarka Khata”.

- Both these books are authored by Ajay Parashar, Director, Information and Public Relations (IPR) of North-East Council.

i.The book “Jalandhar Peeth Ka Rahsya” provides an in-depth insight of the historical and religious significance of various peeths of HP. It was published by Bodhi Prakashan.

ii.The book “Mushtarka Khata”, is a compilation of 16 short stories that shows the various aspects of everyday life. It was published by the Information and Public Relations North East Council(NEC).

IMPORTANT DAYS

World Tourism Day 2024 – September 27  The United Nations (UN)’s World Tourism Day (WTD) is annually observed across the world on 27th September to create awareness about the importance of tourism. The day also promotes tourism as a driver of economic growth, inclusive development and environmental sustainability and offers leadership

The United Nations (UN)’s World Tourism Day (WTD) is annually observed across the world on 27th September to create awareness about the importance of tourism. The day also promotes tourism as a driver of economic growth, inclusive development and environmental sustainability and offers leadership

- 27th September 2024 marks the observance of the 44th World Tourism Day.

- The annual observance of WTD is led by the United Nations World Tourism Organization (UN WTO or UN Tourism).

- The theme for World Tourism Day 2024 is ‘Tourism and Peace’.

- The UN WTO has chosen Georgia as the host country of WTD 2024.

Background:

i.During its 3rd session held in 1979 in Torremolinos, Spain, the UN WTO decided to institute World Tourism Day.

ii.The first-ever WTD was observed on 27th September 1980.

About United Nations World Tourism Organization(UN WTO):

The UN WTO / UN Tourism is the UN agency responsible for promoting responsible, sustainable and universally accessible tourism.

Secretary-General- Zurab Pololikashvili

Headquarters– Madrid, Spain

Established– 1970

>> Read Full News

International Day for the Total Elimination of Nuclear Weapons 2024- September 26 The United Nations (UN)’s International Day for the Total Elimination of Nuclear Weapons is annually observed across the globe on 26th September to educate the public regarding the benefits of the elimination of nuclear weapons and raise awareness about the risk posed to humanity by such weapons.

The United Nations (UN)’s International Day for the Total Elimination of Nuclear Weapons is annually observed across the globe on 26th September to educate the public regarding the benefits of the elimination of nuclear weapons and raise awareness about the risk posed to humanity by such weapons.

Background:

i.On 26th September 2013, the United Nations General Assembly (UNGA) adopted the resolution A/RES/68/32 and declared 26th September of every year as the International Day for the Total Elimination of Nuclear Weapons.

ii.The resolution was a follow-up to the UNGA’s first-ever high-level meeting on Nuclear disarmament in 2013.

iii.The first-ever International Day for the Total Elimination of Nuclear Weapons was observed on 26 September 2014.

About United Nations(UN):

Secretary-General– Antonio Guterres

Headquarters- New York, the United States of America(USA)

Members-193

Founded– 24th October 1945

>> Read Full News

*******

Current Affairs Today (AffairsCloud Today)