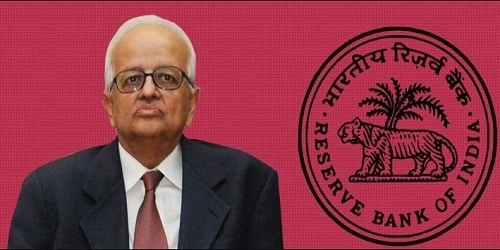

On August 27, 2019, The Reserve Bank of India (RBI) released the report submitted by the panel headed by Bimal Jalan, former RBI governor, which was formed to review the Economic Capital Framework (ECF) of the RBI. The panel was constituted by the central bank in consultation with the government to review the extant ECF of the RBI. It had submitted its report to Governor Shaktikanta Das on August 14, 2019.

The panel was constituted by the central bank in consultation with the government to review the extant ECF of the RBI. It had submitted its report to Governor Shaktikanta Das on August 14, 2019.

The composition of the Committee is as under:

- Bimal Jalan, Chairman

- Rakesh Mohan, Vice-Chairman

- Shri Bharat N. Doshi, Member

- Shri Sudhir Mankad, Member

- Shri Rajiv Kumar, Member

- Shri N.S. Vishwanathan, Member

The recommendations of the report are as follows:

Maintenance of CRB

The committee recommended to maintain RBI’s Contingency Risk Buffer (CRB). It is India’s fund to handle a financial stability. It was recommended to be maintained at a range of 5.5% to 6.5% of the RBI’s balance sheet, which is above the available level of 2.4% of balance sheet as on June 30, 2018.

Consequence of Applicability

Application of these recommendations to RBI’s 2017-18 balance sheet is seen to result in RBI’s risk equity levels in a range of 25.4% to 20.8% of the balance sheet which will enable the RBI to retain one of the highest levels of financial resilience among central banks globally.

Review of economic capital framework every 5 years

Bimal Jalan panel recommended that the revised economic capital framework, under which the RBI decided to transfer Rs 52,637 crore excess provisions to the government, be reviewed every 5 years. If there is a significant change in the RBI’s risks and operating environment, an intermediate review may be considered.

Accounting year

RBI accounting year (July-June) may be brought in sync with the fiscal year (April to March) from the financial year 2020-21 as it could reduce the need for interim dividend being paid by the RBI.

Surplus distribution policy

It has recommended a surplus distribution policy which targets not only the total economic capital (as per the extant framework) but also the realised equity level of the RBI’s capital. It will help bring about greater stability of surplus transfer to the Government, with the quantum of the latter depending on balance sheet dynamics as well as the risk equity positioning by the Central Board.

No transfer of unrealised valuation buffers

There will be no transfer of unrealised valuation buffers. These will be used as risk buffers against market risks.

Payment of Interim dividend

In the upcoming years, interim dividend to the government may be paid only under exceptional circumstances.

Financial stability risk provisions

RBI’s financial stability risk provisions need to be viewed for what they truly are, i.e, the country’s savings for a rainy day, built up over decades, and maintained with the RBI in view of its role as the Lender of Last Resort. Its balance sheet has to be demonstrably credible to discharge this function with the requisite financial strength.

Expected Shortfall (ES) methodology

i. It has recommended adopting the Expected Shortfall (ES) methodology in place of the extant Stressed-Value at Risk for measuring market risk on which there was growing consensus among central banks as well as commercial banks over the recent years.

ii. The central banks are seen to be adopting ES at 99% confidence level (CL). The Committee recommended adoption of a target of ES 99.5% CL and a range defined between the target and downward risk tolerance of 97.5% (both under stress conditions).

iii. The range is considered appropriate to address the cyclical volatility of RBI’s valuation balances based on historical analysis.

Transparent presentation of the RBI’s annual accounts

The committee recommended a more transparent presentation of the RBI’s annual accounts with regard to the components of economic capital. The proposed format for liabilities is as under:

- Capital

- Reserve Fund

- Other reserves

- Risk provisions

- Contingency Fund

- Asset Development Fund

- Revaluation Accounts

- Deposits

- Other Liabilities

- Notes in Circulation

About RBI:

♦ Headquarters: Mumbai

♦ Founded: 1 April 1935, Kolkata