- Of the total FDI investment, USD 775.41 million was in the form of equity infusion, USD 382.91 million was in the form of loan, and USD 287.63 million was in the form of issuance of guarantee.

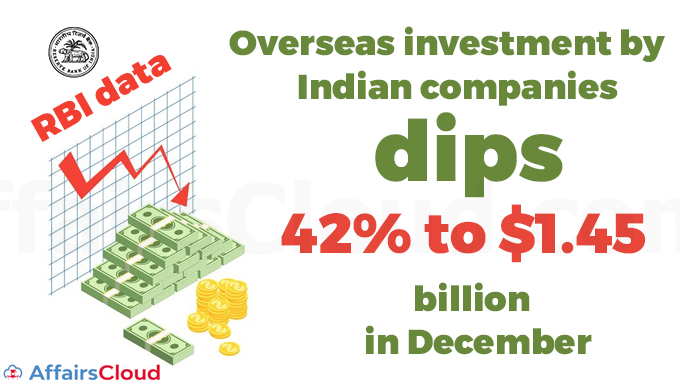

- In November 2020, the total outward foreign direct investment (OFDI) was also trimmed by 27% to USD 1.06 billion as compared to October 2020.

Major Overseas Investors:

—ONGC (Oil and Natural Gas Corporation Limited) Videsh Ltd, headquartered in New Delhi, invested a total of USD 131.85 million in joint ventures and wholly-owned subsidiaries in Myanmar, Russia, Vietnam, Colombia, British Virgin Islands among others.

–Ahmedabad, Gujarat-based Intas Pharmaceuticals invested USD 75.22 million in a wholly-owned subsidiary in the United Kingdom (UK).

–Mumbai headquartered Tata Consultancy Services (TCS) invested USD 27.77 million in a wholly-owned unit in Ireland.

RBI released 3rd “Booklet on Payment Systems”

On January 25, 2021, RBI released the 3rd booklet on Payment Systems titled “Payment and Settlement Systems in India- Journey in the Second Decade of the Millennium 2010-20”described the possibility of a digital version of fiat currency.

The earlier Booklets on Payment Systems were released in the years 1998 and 2008.

- It is in the form of electronic currency, which can be converted or exchanged at par with similarly denominated cash and traditional central bank deposits.

- This 3rd book will serve as a reference document for payment system developments in the country as it states the legal and regulatory environment underpinning the digital payments systems, various enablers, payment options available to consumers, extent of adoption, etc. during 2010 to 2020.

Recent Related news:

i.In the 4th Bi- Monthly Monetary Policy Committee (MPC) 2020-21, GDP growth for Q3FY21 (October-December) is placed at (+)0.1% and (+)0.7% in Q4FY21 (January-March). For H1FY22 (First Half of FY2021-22), it is forecasted at (+)6.5%.

ii.On October 22, 2020, RBI issued the revised regulatory framework for housing finance companies (HFCs) under which the minimum net owned funds (NOF) size for HFCs is fixed at Rs 25 crore.

About Reserve Bank of India (RBI):

Formation– 1 April 1935

Governor– Shaktikanta Das

Headquarters– Mumbai, Maharashtra

Deputy Governors– 4 (Bibhu Prasad Kanungo, Mahesh Kumar Jain, Michael Debabrata Patra, and M Rajeswar Rao)