The World Economic Forum (WEF) has released a new survey based report called The Inclusive Growth and Development Report 2015, this September. It is an effort of the forum to provide an actionable “inclusive growth” policy framework for the nations worldwide, which are struggling to come up with a policy which could solve this issue of inclusive growth. The report says that the current inclusive growth debates are very narrow based. This report is an attempt to deepen and broaden the issue of inclusive growth.

The Inclusive Growth and Development Report 2015 report recognizes that inclusive growth is a complex and multidisciplinary process – to replace widespread poverty with ever increasing middle class prosperity, many conditions needs to be fulfilled.

India has been ranked very low, mostly in the bottom half, globally on most of the parameters for inclusive growth and development even as it fares much better internationally when it come to business and political ethics. India’s overall place in the Global Competitiveness Index 2014–2015 rankings is 71 out of 144 countries.

India has mostly been ranked in the bottom half of the 38 countries that make up our lower middle income bracket. Particularly disappointing is its position in terms of Fiscal Transfers, where it ranks 37th out of 38. It also ranks very low at 32nd for Tax Code and 36th for social protection.In the small business ownership category India was placed at the bottom (38th position).

The report defines Inclusive growth as “output growth that is sustained over decades, is broad-based across economic sectors, creates productive employment opportunities for a great majority of the country’s working age population, and reduces poverty.1 Inclusive growth is about both the pace and pattern of economic growth”

This report provides for in-depth analysis in individual countries about their existing

- Strengths and weaknesses

- Opportunities that exist for improvement

Six major findings from the data

- All countries have room for improvement – no single country scores above average in all 15 subsectors

- It is possible to be pro equity and pro-growth, both are not inversely proportional

- Higher taxes and wider social protection are not against growth and competitiveness. And this is not the only available option for broadening social inclusion.

- Social inclusion policies and institutions are not only found in high income countries

- There are larger regional and cultural similarities

- Current debate on inequality is unduly narrow

The Inclusive growth and Development Report 2015 and India.

- To expand middle class and reduce the share of population living on less than 2$ a day (many of them in poverty despite being Employed), needs the growth to be broad based

- Low Educational Enrollments across all levels

- Quality of education varies – notable differences in educational performance among students from different socioeconomic backgrounds

- Informal Economy is large

- Large Vulnerable employment situation

- Under exploitation of fiscal transfers (Tax)

- Income Tax is regressive

- Low social spending – limiting accessibility of health care and other basic servies

- Problem of sanitation

The report thumbs down India in the following areas

- Unemployment

- Entrepreneurship

- Health Infrastructure

Scores good in the areas of

- Corruption and Rent

- Business and Political Ethics

- Financial Intermediation

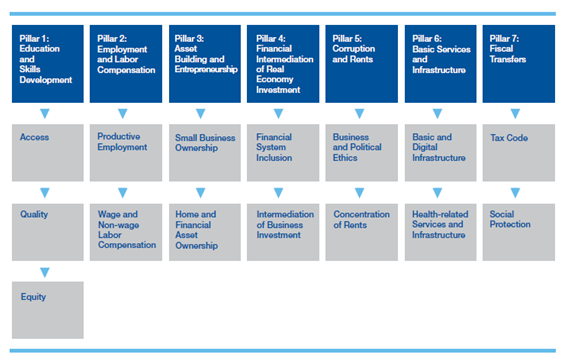

As an answer the report takes 140 indicators into consideration, to provide comparative illustration to the challenge of inclusive growth and development. These indicators measure 112 economies (countries) divided into 4 groups, across 7 pillars and 15 sub pillars.

Grouping of countries is based on similar levels of development (income)

- Advanced

- Upper middle income

- Lower middle income and

- Low income

Sever Pillars and Sub Pillars

- Education and Skill Development

- Employment and Labor Compensation

- Asset building and Entrepreneurship

- Financial Intermediation of Real Economy Investment

- Corruption and Rents

- Basic services and Infrastructure, and

- Fiscal transfers.