An Innovative Initiative To Digitalise India

Lucky Grahak Yojana is an initiative to develop a corrupt free digital india. It is a huge step to completely bring out a cashless India!

Today the news often reads

Demonetization of high value bank notes;

Promotion of cashless digital transactions;

Income tax department raids;

Magical! The governmental steps towards cashless economy are rapidly evolving a DIGITAL INDIA. One such step towards cashless economy is Lucky Grahak Yojana. After demonetization of high value currency notes, the Government is literally pushing rather forcing its citizens to embrace digital transactions. However, there still persist gaps that need to be filled in to completely digitalize India and make it corruption free.

What is Lucky Grahak Yojana?

Lucky Grahak Yojana is a LOTTERY scheme. People who use digital transactions will become eligible for daily and weekly lucky draws and prizes. Thousands of people would get rewards through this scheme every day. Government of India has allocated an amount of Rs 340 crores for this scheme of Lucky Grahak Yojana.

With the motto of “GO DIGITAL, GET BENEFITS”, Prime Minister Narendra Modi has launched two schemes

- Lucky Grahak Yojana

- Digi Dhan Vyapaar Yojana

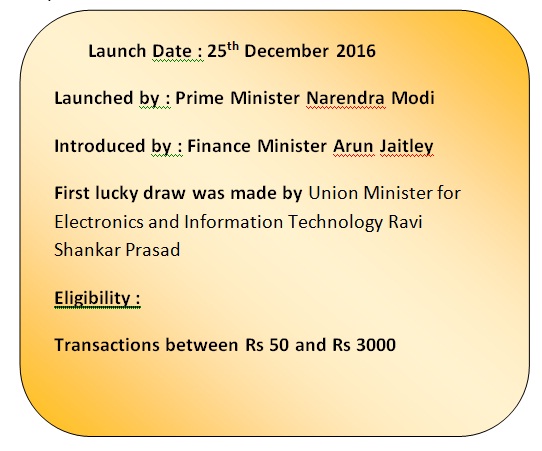

Both the schemes were together launched on the Christmas Eve, December 25 2016 by Prime Minister Narendra Modi. The first draw was made by the Union Minister for Electronics and Information Technology Ravi Shankar Prasad and the union Finance Minister Arun Jaitley.

Financial details of Lucky Grahak Yojana

Every day 15, 000 people will be selected by lucky draw and will be rewarded with a cash prize of Rs 1000. Weekly prizes worth Rs 5, 000, Rs 10, 000, Rs 1 Lakh are also contained in the Lucky Grahak Yojana. Apart from weekly and daily prizes a mega draw is to happen on the day of Ambedkar Jayanti, that is, on 14th April 2017.

Features of Lucky Grahak Yojana

Lucky Grahak Yojana is applicable only for consumers. Especially, it is applicable to the consumers whose transactions are worth from Rs 50 to Rs 3, 000. This is a great step to focus the poor and middle class people.

Lucky Grahak Yojana is implemented by NPCI – National Payment Corporation of India. It is a 100 day programme that started on December 25, 2016 and to end on April 14, 2017.

Types of transactions to be considered under LGY

The following modes of transactions are eligible under Lucky Grahak Yojana

- USSD – Unstructured Supplementary Service Data – A single account number across all the banks

- UPI – Unified Payment Interface

- AEPS – Aadhar Enambled Payment System.

- RuPay cards

The following transactions are not to be considered under the scheme

- Transactions made with private credit cards

- Transactions made using eWallets like Paytm, MobiKwik, Freecharge, etc.

Amount limit for Lucky Draw

The digital and card payments of more than Rs 3000 are not eligible for the lucky draw. Also, the more you use digital payments, the more you would be eligible to get a prize. So it is wise to split the bill to take part in the scheme!

Participants of the scheme

The only two conditions to take part in Lucky Grahak Yojana is that

- The participant has to own a bank account

- The participant has to make digital payments between Rs 50 and Rs 3000

Analysis of Lucky Grahak Yojana

Working of the scheme

NPCI – National Payment Corporation of India Ltd overlooks the transactions of the Lucky Grahak Yojana. NPCI currently manages all the transactions that is happening through USSD, UPI, IMPS, RuPay card, and UPI.

- NPCI first collects all the transaction Ids of the customers who enrolled themselves in the scheme for a stipulated time period.

- The Ids are then categorised as USSD, RuPay, UPI, AEPS, etc.

- Later, a lucky draw is conducted using a special softare exclusively developed for Lucky Grahak Yojana and a lucky inner is selected in each category.

- The selected Ids are then communicated to the corresponding banks through hich the transaction happened.

- The respective bank identifies the ID number and the corresponding account holder of the ID. The bank then sends back the details of the winner to the NPCI.

- NPCI then credits Rs 1000 to the accounts using he fund from NITI Aayog.

Website to know the result

Government has opened a website exclusively for Lucky Grahak Yojana from where one can know if he / she is the inner of the day. A lucky draw is being conducted every day throughout India through Digi Dhan Melas in one city or another.

In the website, one can know if he has won by verifying his mobile number through OTP. However, only the winner can know the result. No names will be provided as the entire process is being conducted with Ids and account numbers.

Lucky Grahak Yojana and UPI

UPI is Unified Payment Interface. Lucky Grahak Yojana is one of the prime steps to accomplish digital goals like UPI. UPI has many benefits. IT is considered as a revolutionary innovation as it is the most advanced methods among all the digital payments.

NEFT charge a minimum of Rs 2.50 per transaction whereas IMPS charges Rs 5. But with UPI it is just Rs 0.50 per transaction. Also it does not demand any details like IFSC code, MICR code, etc. Also it works 24 / 7, so the funds get transferred instantly.

Lucky Grahak Yojana and NITI Aayog

National Institution for Transforming India has introduced many schemes to digitalise India. One such scheme to promote Digital india is Lucky Grahak Yojana. The cash prize for the Yojana is being paid by the NITI Aayog. The CEO of the team is Mr Amitabh Kant.

A detailed report of the scheme can be downloaded in PDF format here

http://niti.gov.in/writereaddata/files/Digital%20Payments%20Incentive%20Scheme_NPCI%20version.pdf

Quiz on Lucky Grahak Yojana– Test yourself

- When was Lucky Grahak Yojana launched?

- Who did the first lucky draw?

- Who launched Lucky Grahak Yojana?

- From where is the fund for Lucky Grahak Yojana being released?

- Who is the CEO of NITI Aayog?

- What was the other scheme that was launched along with Lucky Grahak Yojana?

- What is the prize amount of the scheme?

- Who is eligible for the lucky draw of the Yojana?

- When does Lucky Grahak Yojana come to an end?

- For how many days is the scheme planned for?

References

- https://upipayments.co.in/digital-payment-lucky-grahak-yojana/

- http://economictimes.indiatimes.com/news/politics-and-nation/lucky-grahak-yojana-in-first-draw-15000-winners-get-rewards/articleshow/56187707.cms