- Both HSN & SAC codes are used to classify goods & services under the GST regime.

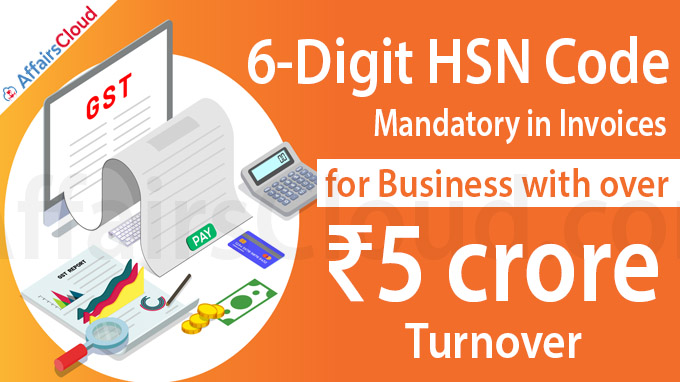

i.Businesses with Turnover of up to INR 5 Crore in the Financial Year 2020-21 would be required to furnish 4-digit HSN code on B2B invoices.

ii.In India, HSN is already in use

- Dealers with turnover of less than INR 1.5 Crore do not need to adopt HSN codes for their commodities.

- Businesses with turnover between INR 1.5 Crore & 5 Crore use 2-digit HSN codes for their commodities.

Harmonised System of Nomenclature Code

- Introduced by the World Customs Organization (WCO) in 1988.

- It was initiated for systematic classification of goods at both national & international levels.

- Universally, 6-digit HSN codes are common.

Usage of HSN in India

- India has been using HSN codes since 1986 to classify commodities for Customs & Central Excise. Recently, it has been used for GST filing also.

- It removes the need to upload details about the goods, which will make the filing of GST returns easier.

- It will also help tax officers with deeper data analytics for every item supplied and help them in arresting tax evasion originating from fake invoices and irregular tax credit claims.

Service Accounting Code

- It is issued by the Central Board of Indirect Taxes and Customs (CBIC) for classifying each service under GST.

- Each service has a unique SAC which can be used in invoices delivered for the services.

- Both HSN & SAC codes are used to classify goods & services under the GST regime.

Recent Related News:

i.March 3, 2021, WCO has recognized the Central Revenues Control Laboratory (CRCL), New Delhi, which functions under the Central Board of Indirect Taxes & Customs (CBIC) as a Regional Customs Laboratory (RCL) of the WCO for the Asia-Pacific Region.

About Central Board of Indirect Taxes and Customs (CBIC):

Chairman – Ajit Kumar

Headquarters – New Delhi